does texas have state inheritance tax

There is a 40 percent federal tax however on estates over 534 million in value. Texas Inheritance Tax and Gift Tax.

State By State Guide To Taxes On Retirees Social Security Benefits Retirement Retirement Strategies Map Diagram

Your estate may be subject to the federal estate tax While there is no state inheritance tax in Texas your estate may be subject to the federal estate tax.

. Delaware collects a gross receipts tax from businesses. Rather a portion of the federal estate tax equal to the allowable state death tax credit on the federal estate tax return was deducted from amount due to the federal government and. In Texas as well as nationwide if you are a named beneficiary of an individual retirement arrangement commonly referred to as an IRA then your share of the distribution is added to your ordinary income and will be taxed at your personal income tax rate.

State inheritance tax rates range from 1 up to 16. Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax. The tax did not increase the total amount of estate tax paid upon death.

Impose estate taxes and six impose inheritance taxes. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Consider the alternate valuation date Typically the basis of property in a decedents estate is.

There are not any estate or inheritance taxes in the state of Texas. For example 62 localities in Alaska collect local sales taxes ranging from 1 percent to 7 percent. There is a big exception to the no inheritance tax rule however.

For example in Pennsylvania there is a tax that applies to out-of-state inheritors. However if a loved one gifts you something elsewhere in the country you may need to pay that states inheritance tax. State Probate Court Finder Surrogates Court Court Source.

Texas is one of a handful of states that does not have an inheritance tax. However in Texas there is no such thing as an inheritance tax or a gift tax. On the one hand Texas does not have an inheritance tax.

However some of these states find ways to collect taxes in other forms. First there are the federal governments tax laws. States that currently impose an inheritance tax include.

Does Texas Have an Inheritance Tax or Estate Tax. For deaths in 2021-2024 some inheritors will still have to pay a reduced inheritance tax Kentucky. However other stipulations might mean youll still get taxed on an inheritance.

The following five states do not collect a state sales tax. There is a 40 percent federal tax. The state of Texas does not have an inheritance tax.

Iowa but Iowa is in the process of phasing out its inheritance tax which was repealed in 2021. While most states in the United States have an inheritance tax Texas doesnt. Finding Information About Taxes On Interest An initial gift of money or property is.

T he short answer to the question is no. This is because the amount is taxed on the individuals final tax return. Surviving spouses are always exempt.

While Texas doesnt have an estate tax the federal government does. The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax.

The Tax Foundation puts the states total tax burden at 98 percent making it the 24th most affordable state the least of any. How Probate Works in State. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. But there is a federal gift tax that people in Texas have to pay. Twelve states and Washington DC.

Many states have an inheritance tax that must be paid in addition to the federal estate tax but not Texas. You can give a gift of up to 15000 to a person without having to pay a. Alaska Delaware Montana New Hampshire and Oregon.

There is also no inheritance tax in Texas. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. However a Texan resident who inherits a property from a state that does have such tax will still be responsible for paying the relevant tax due.

Before 1995 Texas collected a separate inheritance tax called a pick-up tax. Even though no state inheritance taxes are imposed some estates are subject to federal estate taxes. Iowa Kentucky Nebraska New Jersey Maryland and Pennsylvania.

Therefore if you inherit possessions property to sell or keep or money from a loved one in Texas you most likely wont need to pay any tax. However other states inheritance taxes may apply to you if a loved one who lives in those states gives you money so make sure to check that states laws. There is a 40 percent federal tax.

Maryland is the only state to impose both. The short answer is no. Gift Taxes In Texas.

Right now there are 6 states that have an inheritance tax. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. Up to 25 cash back Who Pays State Inheritance Tax.

Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier.

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Federal Income Tax

Texas Estate Tax Everything You Need To Know Smartasset

Pennsylvania Is One Of The Top Ten Tax Friendly States To Retirees American History Timeline Retirement Advice Retirement

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Corporate Income Tax Rates And Brackets Tax Foundation

The 10 Best States For Retirees When It Comes To Taxes Retirement Retirement Locations Retirement Advice

How Much Does It Cost To File A Quit Claim Deed In Texas Rates Vary By State And Law Office But Typically Fall In The Ra Quitclaim Deed Law Office Marketing

State And Local Tax Deductions Data Map American History Timeline Usa Map

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Estate Tax Everything You Need To Know Smartasset

How Do State And Local Individual Income Taxes Work Tax Policy Center

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

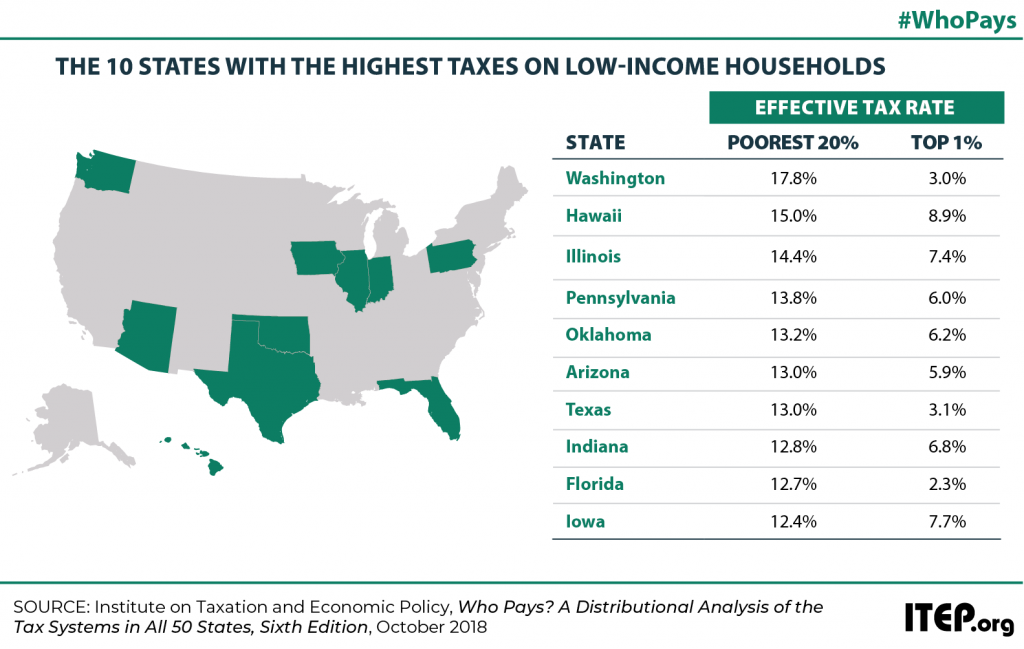

Low Tax States Are Often High Tax For The Poor Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation